Check out the full article here

Fed cuts interest rates, but indicates a pause is ahead

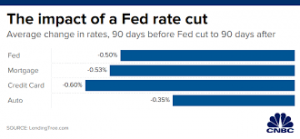

The Federal Reserve’s decision to cut interest rates by a quarter point for the third time this year is meant to bolster the economy.

Everyday Americans may lose some ground.

On the one hand, lower rates often mean cheaper loans, which can impact your mortgage, home equity loan, credit card, student loan tab and car payment.

However, borrowers may not get the full benefit if the economy is weakening, as the Federal Open Market Committee and Chairman Jerome Powell have suggested it is.

In anticipation of an economic slowdown, lenders are less inclined to lend money and may even charge a higher interest rate to hedge against the risk, according to Richard Barrington, a financial expert with MoneyRates.com.

Consumers also likely will earn less interest on their savings accounts and, in some cases, lose buying power over time.

“In this case, a Fed rate cut would not be very good” for savers or borrowers, Barrington said.